utility for service tax return

To save the file right-click and choose save link as. Utility 1051 MB Date of Utility release 24-Aug-2022.

Download Gstr 4 Form Offline Utility V3 3 In Excel Format Sag Infotech Business Software Excel Offline

Postal Service to mail your tax return get proof that you mailed it and track its arrival at the IRS.

. Determine how much income you earned from all your sources combined which would include your salary or pension rent capital gain on the sales of a capital asset interest from your fixed deposits and bank accounts etc. Calculate your Tax Deducted at. To successfully complete the form you must download and use the current version of Adobe Acrobat Reader.

Central. The Public Utility Commission is an independent three-member quasi-judicial commission that regulates the siting of electric and natural gas infrastructure and supervises the rates quality of service and overall financial management of Vermonts public utilities. Public utilities are subject to forms of public control and regulation ranging from local community-based groups to statewide government monopolies.

Directly through the offline utility. In addition to charges for electricity and water your City of Columbia bill could include fees for sewer trash and stormwater. Refer to the tax booklets and their indices to complete the forms.

It is a tax on public service businesses including businesses that engage in transportation communications and the supply of energy natural gas and water. COVID-19 INFORMATION - UTILITY BILLING During the COVID-19 pandemic all creditdebit card transaction fees were suspended for all online payments to the City of Cuyahoga Falls. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City.

Utility sales tax on items such as telephone gas electric or water that is used to further the tax exempt purpose for a nonprofit organization or government agency may be exempt from utility sales tax. Federal Tax Deadline The IRS considers a tax return filed on time if it is addressed correctly has enough postage and is postmarked by the due date. Are most Utility Tax returns filed monthly.

Given that public health orders have been rescinded beginning June 2 2021 and all members of the public will have full access to City Hall in-person creditdebit card transaction fees. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. To successfully complete the form you must download and use the current version of Adobe Acrobat Reader.

Electric gas energy efficiency telecommunications cable television terms. With the utilities you can file Income Tax Returns ITRs by uploading the utility-generated JSON. Federal tax return.

Tax bills are mailed the beginning in July and are due by July 31 of each year. These are the steps to file ITR if you dont have Form 16. Prior to February 2019 these customers seeking a utility sales tax exemption were required to complete Form ST-200 to receive an ST-109.

Public utilities are meant to supply goodsservices that are. Determine the state residency and filing status of the taxpayer. Tax Payment The Citys tax rate is determined each year by the City Council.

Nine Steps to Completing an Indiana Tax Return. Effective July 2005 the Public Utility Tax became an addendum to the Combined Excise Tax Return. Common Offline Utility for filing Income-tax Returns ITR 1 ITR 2 ITR 3 and ITR 4 for the AY 2022-23.

To successfully complete the form you must download and use the current version of Adobe Acrobat Reader. A 1 12 percent per month penalty is added to all unpaid tax bills. 2021 - 600 Corporation Tax Return 2020 - 600 Corporation Tax Return Prior Years - 2019 and earlier.

Migration data for the United States are based on year-to-year address changes reported on individual income tax returns filed with the IRS. A public utility company usually just utility is an organization that maintains the infrastructure for a public service often also providing a service using that infrastructure. 2021 - 600S Corporation Tax Return 2020 - 600S Corporation Tax Return Prior Years - 2019 and earlier.

What rate do I pay. Appointments are recommended and walk-ins are first come first serve. Figure the limits on deductions if the requirement is not met.

Download and save the form to your local computer. Be sure to check with the property owner. Walk-ins and appointment information.

However we can request that you file a return for informational purposes. There are different rates. If you do not anticipate any tax liability for the tax year you can file Form K.

For average utility consumption for a location please contact Utility Customer Service at. A personal service corporation PSC that elects to have a tax year other than a calendar year uses this schedule to. E-filing of Service Tax Returns ST-3 made mandatory for All Assessees wef 01102011 vide Notification No.

In general you need to file Utility Tax returns monthly. 432011 - Service Tax dated 25082011 click here for Notification MOUs with ICAIICWAIICSI regarding ACES Certified Facilitation Centre extended upto 31-3-2013. What is the public utility tax.

This service on the e-Filing portal offers two separate offline utilities for filing ITRs which are as follows. For details click on link. Choose the proper tax form.

However if your utility tax liability is less than 100000 for the prior calendar year you can file your returns for the subsequent year semi-annually. Steps to file ITR without Form 16. Complete a federal return.

Determine if the PSC meets the minimum distribution requirement for the tax year or. Complaints of discriminatory treatment by the Commission or its employees may be lodged in writing with Belinda B. ITR-1 to ITR-4 and ITR-5 to ITR-7.

They present migration patterns by State or by county for the entire United States and are available for inflowsthe number of new residents who moved to a State or county and where they migrated from and outflowsthe. The information below will help you determine if you need to file a state income tax return or if you need to change your withholding so you will not have to file an unnecessary return in the future. Enclose the state copies of the W-2 forms and 1099s if filing.

Post login to the e-Filing portal or. Jackson Public Service Commission of West Virginia 201 Brooks Street Charleston WV 25301 bjacksonpscstatewvus or by calling 304 340-0300. Mail Your Tax Return with USPS.

Call 302-736-7022 for further details Tax Assessors Office City of Dover Property Tax Rate Effective 712022- 435 cents per 100.

Accounting And Bookkeeping Bookkeeping Bookkeeping Software Bookkeeping Services

Fun Facts About Lacerte Tax Software For Professional Tax Preparers Tax Software Infographic Tax Preparation

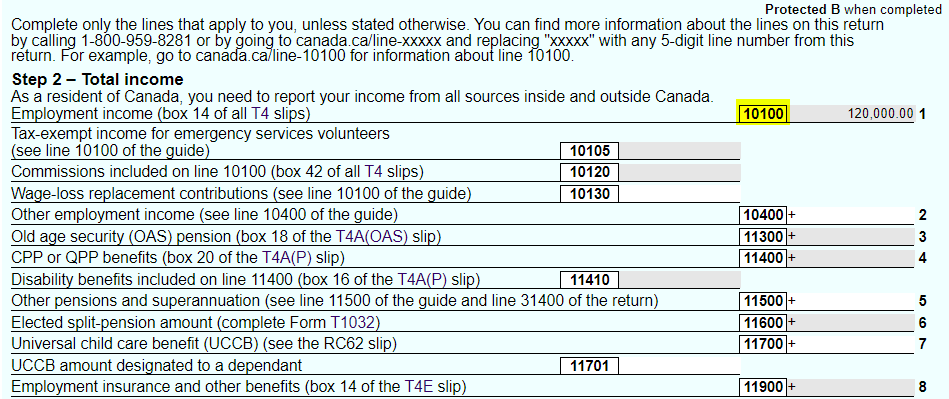

What Is Line 10100 Or 101 On Your Tax Return Loans Canada

Free Pan Allotment In 10 Minutes Income Tax Department Launches New Utility Free Pans Income Income Tax

Functionalbest Of Self Employed Tax Deductions Worksheet Check More At Https Www Kuprik Se

Kdk Tds Software Arm Yourself With Tax Solutions That Meet Your Needs Today And Grow With You Tomorrow Suppo Tax Software Tax Deducted At Source Filing Taxes

Scanned Document Editing Service Tax Deductions Deduction Bank Statement

Fillable Form W2 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Irs Taxes Tax Forms

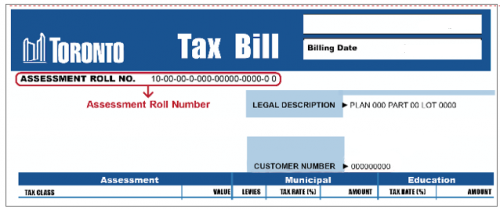

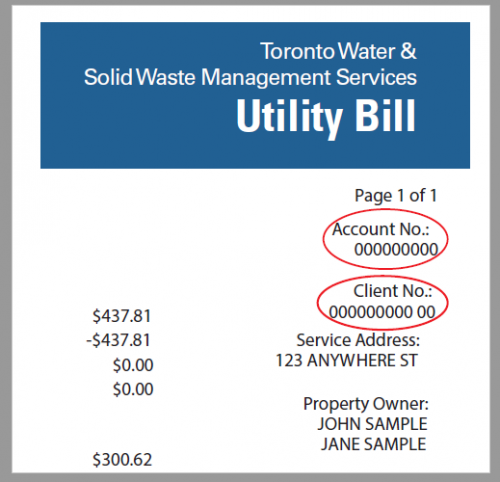

Tax And Utilities Answers City Of Toronto

Free 32 Financial Statement Templates In Ms Word Pages Google Docs Pdf Statement Template Financial Statement Income Statement

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Banking App Credit Card Hacks Irs

Tax Return Personal Fake Tax Return Payroll Template Tax

Gst Registration And Return Filing Services You Can Depend On In 2022 Tax Refund Registration Goods And Services

Tax And Utilities Answers City Of Toronto

Easy Steps To Enroll Digital Signature Certificate On New Tax 2 0 Portal Government Portal Tax Software Digital

About Your Utility Bill Canadian Niagara Power Utility Bill Bills Power Bill

Tds Due Date List May 2020 Accounting Software Solutions Date List

Algeria Aec Algerian Energy Company Utility Bill Template In Word And Pdf Format In 2022 Energy Companies Bill Template Templates

Request It Service Form Template Word Template Words Templates