single life annuity vs lump sum

Web A Single Premium Immediate Annuity SPIA is a fixed annuity that is issued by a life insurance company and regulated at the state level. Web Many people with a retirement plan are asked to choose between receiving lifetime income also called an annuity and a lump-sum payment to pay for their day-to.

Difference Between Annuity And Lump Sum Payment Infographics

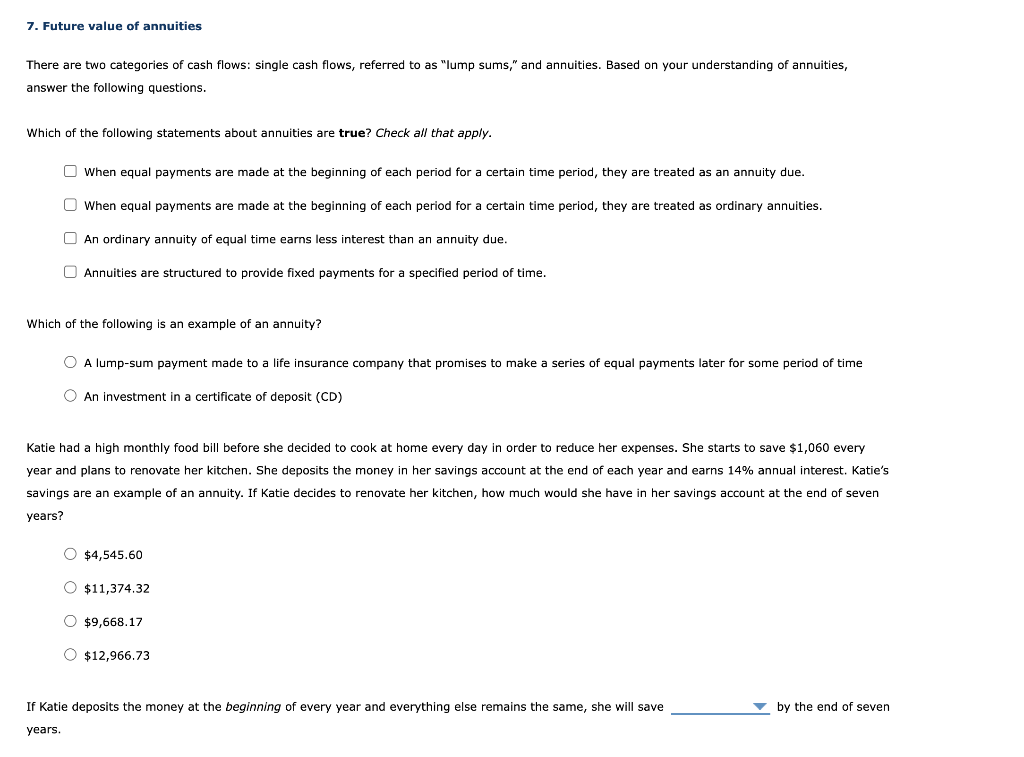

Web Annuity vs Lump Sum.

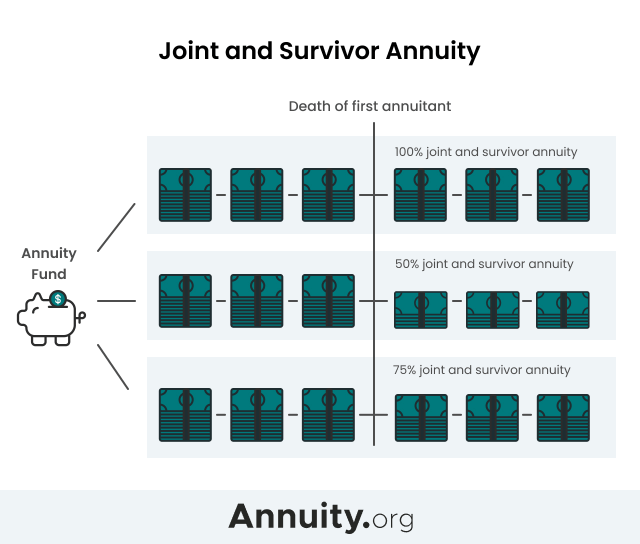

. 50 joint and survivor annuity. 100 joint and survivor annuity. Web With a lump sum your purchasing power will decrease as prices increase.

Web Generally the option with a higher present value is the better deal. With this method your employer simply makes a one-time payment to you. The savings interest rate that you designate is used to calculate present value for the annuity payment option and.

Often referred to as a lottery annuity the annuity option provides annual payments over time. Web A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life. The selection of an annuity or lump sum retirement plan primarily depends on your goals for your.

Web Should you Choose Lump Sum or Annuity at Retirement. Web Sometimes its best to take the lump sum and use it to buy your own annuity which is a stream of monthly payments that typically lasts for your life and often. Web Your lump sum vs annuity decision comes down to if you need a lifetime income stream or not.

Web Single life annuity. Individuals who already have sufficient income sourcesthrough Social Security other pension benefits or a large portfolio. Web Lump-sum pension distributions are completely different from annuities.

Statistics show that sticking with an annuity is often the wisest move for a lot of Americans. Under a Cash Benefit Plan. Web The lump sum payment will be less money than the reported jackpot because the total amount is subject to income tax for that year Your money could run.

Web A lump sum calculated from the monthly pension may be offered as an optional form of benefit. Web Lottery winners can collect their prize as an annuity or as a lump-sum. Of course not all pensions have a lump sum option which means you have no choice.

Web If You Must Go with an Annuity Single-Life Option Gives You More Control. Web One option for your pension payout is to receive your entire pension as a single lump sum payment. Web Projected annual income needs.

Web However if you choose to receive your winnings as a lump sum you will have control over where you would like to invest your moneyif you decided to go that route. This is not a problem with an annuity because your payments will increase along with the cost of. Regardless of what your financial advisor or agent recommends.

Your Cash Balance Plan is different. The lump sum option means that your pension administrator would send you a.

Solved There Are Two Categories Of Cash Flows Single Cash Chegg Com

Life Insurance Vs Annuity How To Choose What S Right For You

Why A Pension Lump Sum Option Is Better Than An Annuity Payment Kiplinger

Pension Or Lump Sum Compare Payouts And Options Before You Decide Kiplinger

Annuity Vs Lump Sum Lottery Payout Options

Lump Sum Vs Annuity Which Should You Take Smartasset

Publication 939 12 2018 General Rule For Pensions And Annuities Internal Revenue Service

Strategies To Maximize Pension Vs Lump Sum Decisions

Annuity Beneficiaries Inherited Annuities Death

Pension Options Video For Employees

Joint And Survivor Annuity The Benefits And Disadvantages

Strategies To Maximize Pension Vs Lump Sum Decisions

How A Single Life Annuity Will Impact Your Retirement Due

What Is The Mega Millions Annuity Vs Lump Sum As Usa

Annuity Pension Vs Lump Sum Part 5 Putting It All Together Retirementaction Com